- Economy

- No Comment

ZiG money officially debuts in Zimbabwe’s sixth effort at a revamped currency

By Bloomberg News

- Stock exchange rebases share prices to new currency, says ceo

- Parallel market cut off as banks, mobile money change systems

ZiG, Zimbabwe’s new currency, began trading on Monday as businesses struggled with the nation’s sixth attempt at introducing a revamped unit.

Reserve Bank Governor John Mushayavanhu set the introductory exchange rate of 13.56 per US dollar for the ZiG, short for Zimbabwe Gold, where it started trading. The interbank market will set the daily exchange rate from now on, Mushayavanhu said during an April 5 presentation of the monetary policy statement.

Banks, retailers, telecommunications companies and other firms spent the weekend reconfiguring their systems to adopt ZiG ahead of business resuming Monday. Only US dollar transactions were unaffected by the currency change.

Still, only about half of the nation’s 19 banks are expected to be able to process ZiG transactions by Monday morning, according to Zabron Chilakalaka, the chief executive officer at ZimSwitch, the national payments platform. ZimSwitch allows individuals to send 2,400 ZiG per transaction ($176) and 8,000 ZiG a month.

| Read More on Zimbabwe’s Currency Crisis: |

|---|

The Zimbabwe Stock Exchange, which has 56 listed companies, said all share prices, price sheets and market reports will now be denominated in the new currency.

“All the ZSE indices will be rebased to 100 basis points,” said Justin Bgoni, the chief executive officer of the bourse. “The rebasing is necessary to allow the indices to accurately reflect the performance of the market in the context of the new currency ZiG.”

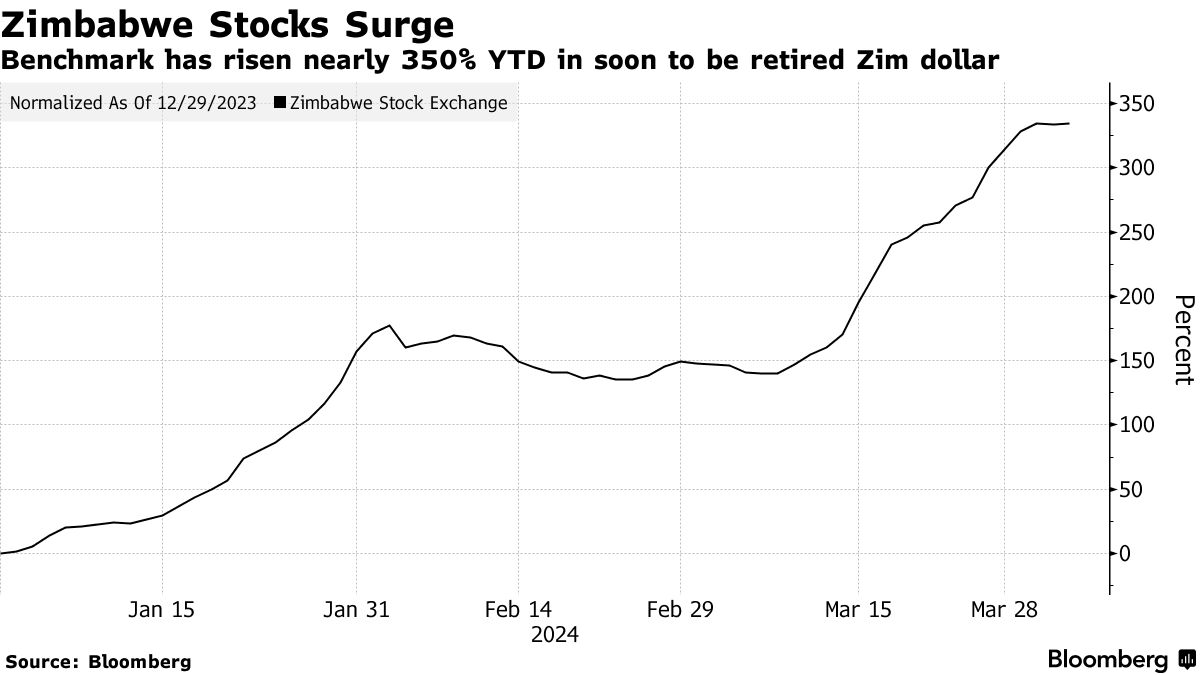

Stocks on the main exchange in the capital, Harare have risen more than three-fold since the start of the year. A stocks surge in the southern African nation is usually cause for concern, as it points to an inflation spiral and investors seeking a hedge to protect the value of their money. Annual consumer prices rose to 55.3% in March, a seven-month high.

The new currency will also pose a test for listed firms when they compile their financial statements, according to Lloyd Mlotshwa, the head of research at IH Securities, a Harare-based brokerage firm.

“From an audit perspective now that there has been a conversion, they’ll need to qualify all Zimbabwe dollar financials,” he said. “The next battle will be seeing how auditors handle that.”

Even before the official scrapping of the Zimbabwe dollar as legal tender, tell-tale signs pointed to authorities quietly giving up on defending it, an unusual departure from the previous stance of fiercely backing the local unit.

The currency breached several key milestones in one of its worst starts of the year since being brought back into circulation five years ago, plunging 40% on the street market in January. It then went on to lose value every single trading day of the year on the official market, failing to prompt any reaction from authorities to halt the decline.

As a result, day-to-day transactions increasingly became hard to comprehend with zeros returning to the local currency evoking bitter memories for citizens of the days of hyperinflation.

When it resumed circulation in 2019, the Zimbabwe dollar began trading at an official exchange rate of 2.5 per greenback. When it finally met its demise on Friday, it was officially trading at 30,671 per US dollar, having lost 80% of its value since the start of this year.

The Zimbabwe dollar was the world’s second-worst performing currency, trailing the Lebanese pound.

There was “dire need for drastic change” in the Zimbabwean monetary system, according to Oxford Economics. “New leadership at the RBZ will support the message that this time is different,” wrote Jacques Nel, the head of Africa macro at Oxford Economics in a client note. “But a Zimbabwean population all too familiar with false new dawns will take some convincing.”

Over the years, the Zimbabwe dollar met with rapid bouts of inflation, a raging parallel market and citizen’s preference including the government’s own to conduct most commerce in US dollars. Demand for US dollars was further fueled by the onset of the coronavirus pandemic in 2020.

“We want a solid and stable national currency for this country,” said Mushayavanhu at his inaugural press briefing. “We haven’t had that for many years.”

The switch to ZiG by service providers over the weekend also had an unintended consequence: cutting off the parallel market.

Most parallel market traders rely on using electronic payments done over banking and mobile money platforms to transact. Even those that trade in Zimbabwe dollar banknotes run the risk of holding worthless bills as they will be replaced by ZiG banknotes and coins. The new currency notes will be released April 30, the central bank said.

A single Zimbabwe dollar was exchanging hands at Z$40,000 per US dollar, according to ZimPriceCheck.Com, a website that monitors official and unofficial exchange rates.

“What we don’t know is whether we will get a parallel rate which emerges,” said Mlotshwa. “We don’t know what that rate will look like and how street traders will go about that. We wait to see how that plays itself out.”

Zimbabwe also enjoyed some relief owing to the currency change as interest rates were slashed from a world record high of 130% to 20%. Annual inflation is seen by the central bank ending the year in single digits, at between 2% and 5%.