- Economy

- No Comment

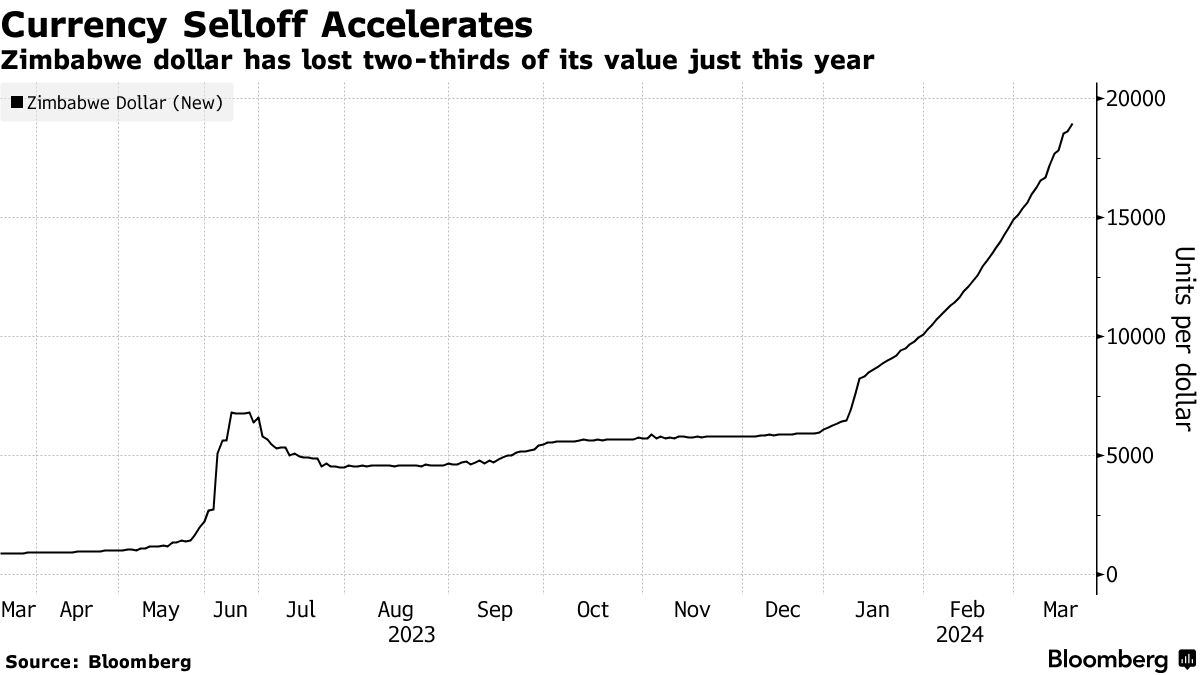

Loaf of bread now costs Z$19,357 as ZimDollar sinks; currency has lost 68% this year

By Bloomberg News

- Nation plans launch of structured currency with gold standard

- Central bank avoids intervention despite sinking currency

Zimbabwe, the poster child of hyperinflation, is allowing a free fall in its currency that it’s no longer keen to defend and is instead working on a new exchange rate potentially backed by gold.

The country’s local dollar has weakened against the US dollar every day in 2024, sending the price of a single loaf of bread from Z$6,105 to Z$19,357 in a mere 11 weeks. Such a loss of purchasing power has historically pushed the central bank to intervene and arrest the slide, but this time, there has been no action.

“They’ve left the exchange rate to go,” said Tony Hawkins, an economist and former professor at the University of Zimbabwe. “I had never thought that the rate would be allowed to go like this. It means they are thinking of a new currency.”

This is Zimbabwe’s sixth attempt to have a functional local currency since 2008 when inflation crossing 231 million percent left it worthless. Despite previous failures due to lack of public confidence — the oxygen of any fiat currency — President Emmerson Mnangagwa announced this February his government will introduce a “structured currency.”

Then, Finance Minister Mthuli Ncube said it may be backed by gold and the central bank postponed its monetary-policy statement to give final touches to the plan.

When Zimbabwe makes the switch, it will be the only country in the world with the gold standard.

“There are currently no nations that back their currencies with gold or any other precious metal,” said Peter C. Earle, a senior economist with the American Institute for Economic Research. “There have been political overtures in the past to create some form of commodity standard, but the siren call of money printing always gets the upper hand.”

Zimbabwe’s tendency to keep printing money means its citizens show little faith in any legal tender brought forward by the government. The US dollar accounts for 80% of all economic transactions in the country, according to the national statistics agency. Even when people want to use it, the Zimbabwe dollar can hardly buy anything. The highest denomination, the Z$100 note, must be carried in large wads to carry out the smallest of transactions.

The currency has lost 68% against the US dollar this year, to Z$18,992. It trades much weaker on the widely used parallel market at Z$22,000, according to the ZimPriceCheck.com website. Despite the losses, the central bank hasn’t conducted any dollar auction.

“Money printing is a very effective tool for dealing in political favours,” Earle said. “And when inflation eventually arrives, as it always does, it can be blamed on enemies of the regime in power: the wealthy, the West, speculators, and so on.”

Once, the government ordered a temporary shutdown of the country’s largest mobile-money platform. On other occasions, they imposed a ban on bank lending and even halted payments to government contractors they suspected of colluding in the selloff.

Policy Flip-Flops

Zimbabwe suspended publishing inflation figures after July 2008, when the measure reached an annual 231,162,000%, according to data compiled by Bloomberg. The government now publishes a new inflation series, under which consumer-price growth currently stands at 47.6%.

Zimbabwe has endured a series of policy U-turns as it searched for a viable currency to call its own. Authorities abandoned the worthless local dollar and embraced the greenback in 2009. Then, they reintroduced the Zimbabwe dollar in the electronic form around 2015, pegged to the US currency. That changed in 2018, when the peg was removed, impoverishing thousands of Zimbabweans who held their savings in the electronic currency.

Lingering Uncertainty

While people wait for the newest plan on the currency, the government itself is signalling its lack of confidence in the Zimbabwe dollar by using the greenback for some of its activities such as passport fees and road tolls.

Meanwhile, the central bank is preparing for a new governor at the end of April, when John Mushayavanhu will replace incumbent John Mangudya. An announcement of the structured currency may be waiting for the leadership change. In the meantime, the nation has been shoring up its bullion reserves, presumably to support the gold standard.

Many questions remain unanswered. People are waiting to see whether an entirely new currency will be launched or a gold standard applied to the current one. They also want to know if the US dollar will be banned again. That’s left businesses in a limbo, said Mike Kamungeremu, president of the Zimbabwe National Chamber of Commerce.

“Everyone is keen to know what exact form the structured currency will be,” Kamungeremu said. “Given past losses suffered due to currency reforms people tend to employ a wait and see approach.”