- Featured

- No Comment

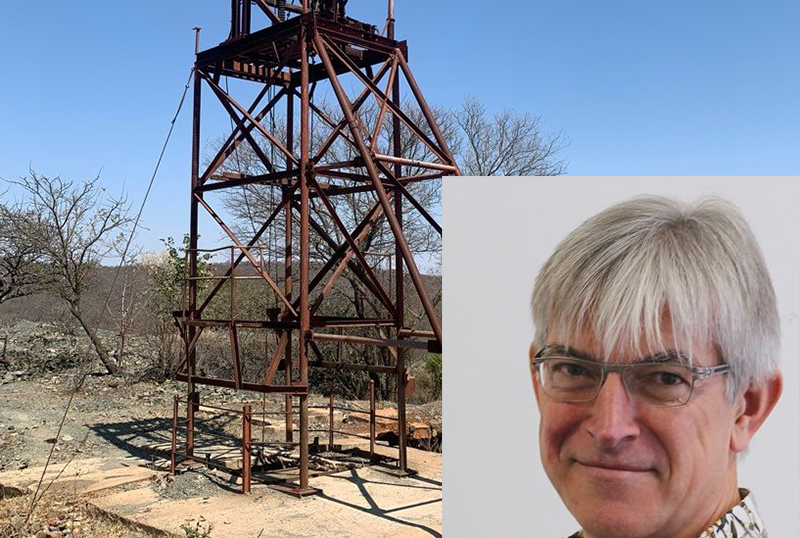

Canada-based Pambili signs option to purchase Zimbabwe gold mines

By Denis Gwenzi

CANADA based Pambili Natural Resources Corporation has signed an option agreement to acquire a group of gold mines and claims located in the Gwanda district, Matabeleland South.

The company confirmed the deal Wednesday, indicating it had secured a 12-month option with Long Strike Investments (Private) Limited giving Pambili the right to acquire 21 claims controlled by the London Wall group of gold mines.

The claims include the previously producing London Wall and New Jessie mines, “which the Company believes to have significant potential to be explored, evaluated and reopened by using more modern methods and technologies”.

Commenting on the development, Jon Harris, Chief Executive Officer of Pambili Natural Resources, said “This opportunity is a major step forward for Pambili.

“We are excited to establish a second mining hub with the potential to deliver on Pambili’s target of becoming a significant gold producer in Zimbabwe.

“The Option to acquire the London Wall group of mines provides Pambili with a potentially significant source of near-term cash flow, and also provides time to further evaluate the Claims and Mines ahead of a possible exercise of the Option.”

He added, “Although the historical data has yet to be independently verified, the reported figures corroborate previous production records, and we are excited to have this opportunity to confirm the potential of the project.

“The immediate goal will be to rehabilitate the static leach tanks at London Wall and commence re-processing the gold tailings to generate revenue.”

A “Right to Mine” Agreement, signed as part of the Option, allows Pambili to commence gold production at London Wall, initially by processing tailings and sands, and then moving into underground mining.

Meanwhile, a statement announcing the deal explained that should “Pambili exercise the Option, the total acquisition cost of the Mines and Claims will be US$1 million, to be satisfied through a combination of cash and Pambili shares.

“The subsequent Share Purchase Agreement will be subject to the approval of the Toronto Venture Exchange, and any Pambili shares issued to complete the potential acquisition will be subject to a statutory four-month-and-one-day hold.”

The company said its strategy is to become a significant gold producer in Zimbabwe through the aggregation and consolidation of brownfield and producing projects.

“The Option provides Pambili with the opportunity to establish a second mining hub around which to increase both its Zimbabwe footprint and its gold production in the near term.”

Pambili has traditionally operated in the oil and gas sector, and still has legacy obligations with properties in Western Canada.

However, a in 2021 the company reported that it was investigating opportunities in the mining sector of southern Africa and, two years later sealed a deal to acquire the Golden Valley project, “a mine in the Bulawayo Greenstone Belt with a history of high-grade underground mining”.